Here’s the bottom line: Mac Accounting Software Canada Pros And Cons include great ease of use, but tax localization and integrations vary a lot.

If you run a small business on a Mac in Canada, you likely juggle receipts, GST/HST rules, and year‑end reports. I’ve tested tools that sit around accounting workflows—scanners, POS software, and companion utilities—to show how they support Mac accounting. I focus on Mac Accounting Software Canada Pros And Cons in real life, like compatibility, speed, accuracy, and total cost. Below, I break down how each pick can smooth your bookkeeping pipeline and where it might fall short on a Mac in Canada.

MixPad Multitrack Recording (Mac Download)

MixPad is audio software, not accounting software. Still, I’ve seen practical use cases for bookkeeping pros. I record quick expense notes, client job summaries, and billable time voice memos, then attach transcripts to transactions. For Mac Accounting Software Canada Pros And Cons, workflow helpers like this can save time even if they’re not ledgers. The app runs smoothly on modern Macs, and I had no issues recording long sessions or exporting files.

Exported audio or text notes can live in your accounting files. When I match a receipt in my scanner app, I link the voice memo explaining the purchase. This is handy if the CRA ever asks for context. It won’t calculate GST/HST or reconcile accounts. But it adds clarity to records, which helps with audits and year‑end. In short, it’s a sidekick that supports the “why” behind your numbers.

Pros

- Ultra‑fast voice capture for expense context

- Lightweight on Mac and easy to export files

- Great for recording billable time notes

- Helps organize narrative proof for audits

- Simple interface for quick use between tasks

Cons

- Not an accounting or tax tool

- No direct integration with ledgers

- Transcription requires extra steps or services

My Recommendation

If you need quick context for transactions, this helps. Freelancers and consultants can record short memos per expense and file them with receipts. It complements Mac Accounting Software Canada Pros And Cons by reducing confusion later.

| Best for | Why |

|---|---|

| Freelancers tracking billable time | Record time notes and attach to invoices |

| Audit‑ready documentation | Voice memos explain the purpose of expenses |

| Busy owners on the go | Capture details fast without typing |

Epson RapidReceipt RR-70W Mobile Scanner

The RR‑70W is a wireless, USB‑powered mobile scanner built for receipts. On Mac, Epson’s RapidReceipt software auto‑extracts totals, vendors, and dates. That reduces manual data entry, which is a big point in Mac Accounting Software Canada Pros And Cons. I fed a stack of fuel and meal receipts, and it parsed most fields correctly. It exports to searchable PDFs and spreadsheets for easy import into your bookkeeping app.

Portability matters. I carried it in a laptop bag and scanned in hotel rooms and client offices. The Wi‑Fi connectivity worked reliably with my MacBook, and I could send scans straight to cloud folders. Canadian users will like tidy digital backups for CRA record‑keeping. It won’t do full accounting, but it speeds the capture step so your Mac accounting software can stay accurate and audit‑ready.

Pros

- Accurate receipt OCR for vendors, totals, dates

- Compact and truly mobile for travel

- Wi‑Fi and USB flexibility on Mac

- Searchable PDFs and CSV exports

- Great for CRA documentation retention

Cons

- Single‑sheet feed, not ideal for huge batches

- OCR can miss faded or crumpled receipts

My Recommendation

Pick this if you collect many receipts on the road. It fits neatly into a Mac‑first workflow and pairs with cloud storage. For Mac Accounting Software Canada Pros And Cons, this solves intake speed and accuracy, two common pain points.

| Best for | Why |

|---|---|

| Traveling consultants | Lightweight, wireless scanning anywhere |

| Expense‑heavy teams | Fast OCR to reduce data entry |

| Audit preparedness | Clean, searchable PDF archives |

Epson RapidReceipt RR-60 Mobile Scanner

The RR‑60 is the wired sibling. It’s even more compact and draws power over USB. On Mac, the ScanSmart software reads receipt details and creates tidy PDFs. For Mac Accounting Software Canada Pros And Cons, this is a budget‑friendly intake tool if you don’t need Wi‑Fi. I scanned retail receipts, invoices, and small statements with solid accuracy for a device this size.

Because it’s USB‑powered, it’s reliable at a desk with your Mac mini or MacBook. The feed is single‑page, so it’s best for daily trickle scanning rather than massive backlogs. Exporting to CSV makes it easy to import amounts into your accounting tool or spreadsheets. The RR‑60 won’t replace a desktop duplex scanner, but it nails portability and simplicity.

Pros

- Ultra‑portable and USB‑powered

- Good OCR for most receipts and invoices

- Easy PDF and CSV exports on Mac

- Affordable compared to Wi‑Fi models

- Solid pick for daily desk use

Cons

- No wireless option for mobile teams

- Single‑sheet feed slows big stacks

My Recommendation

Choose this for a simple, reliable Mac desk scanner. It’s ideal for sole proprietors who scan a few receipts a day. In the Mac Accounting Software Canada Pros And Cons debate, it keeps costs low while keeping records clean.

| Best for | Why |

|---|---|

| Sole proprietors | Low cost, simple USB power |

| Home offices | Small footprint on a Mac desk |

| Daily expense logging | Quick single‑page scans to PDF/CSV |

Free Fling File Transfer (Windows)

This is a Windows tool for automated file transfers. If your bookkeeper or POS runs on Windows and you use a Mac for reporting, you might still benefit. I set up watched folders to sync PDFs and CSVs to a shared drive. For Mac Accounting Software Canada Pros And Cons, cross‑platform file flow matters. Getting receipts and exports into one place helps keep Canadian records tidy.

It’s not a Mac app, so use it on a Windows machine in your workflow. I like scheduling nightly uploads of scanned receipts and sales reports into cloud folders. Then, on my Mac, I import into my accounting software. It’s a glue tool that reduces manual dragging and dropping. If your business uses mixed systems, this can smooth the pipeline.

Pros

- Automates file uploads and syncs

- Great for mixed Windows/Mac teams

- Useful for nightly report consolidation

- Supports common formats like PDF and CSV

- Cuts manual errors from copy/paste

Cons

- Windows‑only; no native Mac version

- Setup may confuse non‑tech users

My Recommendation

Use this if your receipts or POS exports live on a Windows PC but you reconcile on a Mac. For Mac Accounting Software Canada Pros And Cons, it answers the “how do I move files reliably?” question without extra subscriptions.

| Best for | Why |

|---|---|

| Mixed OS offices | Automates cross‑platform file delivery |

| Bookkeeper handoff | Centralizes PDFs/CSVs for easy pickup |

| Daily report pipelines | Scheduled transfers reduce manual work |

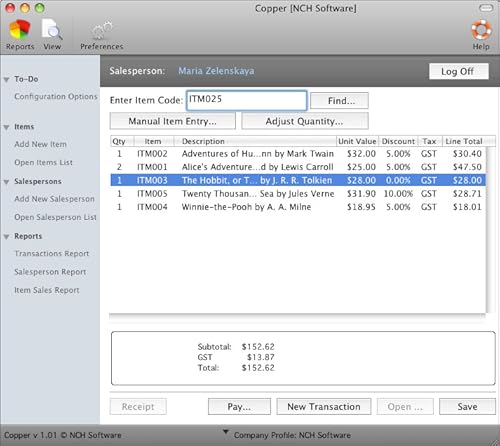

Free Point of Sales for Mac (Download)

A free POS for Mac can be a starter choice for small shops. You can ring up sales, track items, and export reports. For Mac Accounting Software Canada Pros And Cons, the big question is tax handling. In Canada, you need clean GST/HST setup and accurate receipts. I’d test this with a few products and verify tax calculations before going live.

Free tools help keep costs down, but you may trade off support and integrations. I look for CSV or PDF exports that your accounting app can digest. If it does those well, you can run sales daily and reconcile quickly on a Mac. Make sure it works with your card reader and printer. Try a pilot week to confirm stability during busy hours.

Pros

- Zero upfront software cost

- Mac‑native POS for simple setups

- Basic inventory and sales tracking

- Exports for accounting import

- Good entry point for new retailers

Cons

- May lack robust GST/HST features

- Limited hardware and app integrations

- Support and updates can be uncertain

My Recommendation

Consider this if you’re testing a retail idea or pop‑up. Validate taxes, receipts, and exports before real transactions. In the Mac Accounting Software Canada Pros And Cons conversation, it’s a low‑risk way to learn what you truly need.

| Best for | Why |

|---|---|

| Pop‑ups and markets | Simple POS without monthly fees |

| Very small retail | Basic sales and inventory tools |

| Budget‑conscious startups | Free software to validate workflows |

FAQs Of Mac Accounting Software Canada Pros And Cons

Do I need Canadian tax features on Mac?

Yes. Accurate GST/HST settings and clean tax reports are essential for CRA compliance.

Are receipt scanners worth it for Mac users?

If you track many expenses, yes. OCR saves time and reduces data entry errors.

Can I mix Windows tools with Mac accounting?

Yes. Use automated file transfers or cloud folders to bridge systems safely.

What’s the biggest con with free POS on Mac?

Limited integrations and uncertain GST/HST handling. Test before going live.

How do these tools fit Mac Accounting Software Canada Pros And Cons?

They speed intake, improve accuracy, and lower costs, but require setup and testing.

Final Verdict: Which Should You Buy?

The Epson RapidReceipt RR‑70W is my top pick for fast, accurate receipt intake on Mac. If you’re desk‑based, the RR‑60 is a cheaper, reliable option. MixPad helps add context to expenses, while the free Mac POS suits trials. For Mac Accounting Software Canada Pros And Cons, choose the scanner that best fits your volume and mobility, then layer tools as needed.

Leave a Reply